tax on forex trading in canada

The best part about Forex trading taxes Canada is that 100 of profit and loss are eligible for taxing and tax deduction which relieves the broker. The amount of tax you pay will depend on how much you earn and which method you use to.

Day Trading Don T Forget About Taxes Wealthfront

For example assume that you are a Canadian traveler with C10000 in cash.

. Taxation on Forex trading in Canada. Modern forex trading has digitized a relatively old method of making money. However investors will only have to report the amount of their net gain.

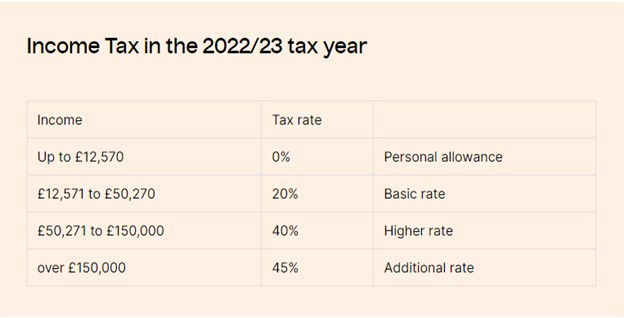

Tax in Canada for Forex Trading. The tax rate on Forex gains rate from country to country for example the maximum tax rate in the USA is 37 while it is 20 in the. For day traders any profits and losses are treated as business income not capital.

Gains made from Foreign exchange will be considered as capital gains or losses. Tax reporting on forex trading in Canada is straightforward. When you get to New York you.

Most retail traders with low investments are tax-exempt all over the world. Yes or No both depending on the countrys law. But we highly recommend traders trade only with IIROC-regulated forex brokers.

Learn to Day Trade. Any income or salary earned is subject to capital gains tax and forex traders should be prepared to pay up to 50 on profits. If you trade CFD forex or spot you need to pay taxes of 10 if you earn less than 50000 or 20 for profits above 50000 the tax-free limit.

Foreign exchange gains or losses from capital transactions of foreign currencies that is money are considered to be capital gains or losses. When do I have to pay taxes. As a result you cant use the 50 capital gains rate on any profits.

In summary forex trading is taxed in Canada as any other income as long as its above 200. However the 2010 CRA Income Tax Interpretation Bulletin makes it clear that forex trading taxes in Canada can be either business income or capital gains. Learn to Day Trade.

That isnt saying how its treated. Answer 1 of 5. In Canada it is important to pay taxes when you make a profit or even when.

Is it only when I withdraw the funds from. Tax on forex trading in Canada. Business Income and Losses.

I just started trading forex a few months ago and went from 10k to 14k on Oanda. If you trade foreign exchange or anything else as a profession then your income would be considered regular income and would be taxed at your normal tax rate. The CRA says you treat it as capital gainslosses translated into Canadian dollars if the gain or loss is more than 200 CAD.

Httpsbitly36x4Dy1Get my FREE Journal Watchlist. Most notable in the bulletin is. With some assets its pretty clear-cut as to whether they will be treated as income or capital gains.

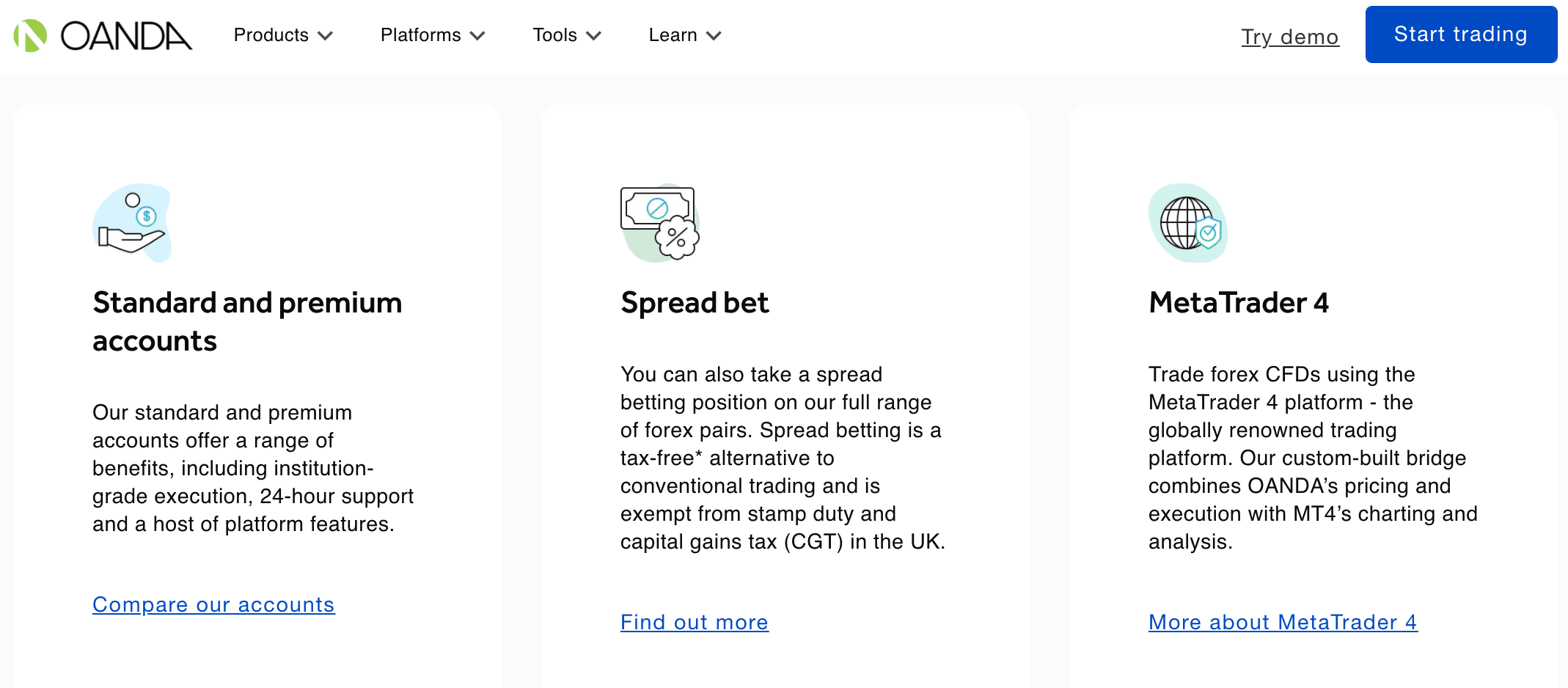

Httpsbitly3JPCiRWGet my FREE Journal Watchlist. In the UK trading from a spread betting account is tax-free. Forex trading is mostly taxed with a capital gains tax.

It could be business income. Canadian tax laws on currency trading are another topic of interest. Yes forex traders pay tax in the United Kingdom.

Keep in mind that the tax you pay on your.

7 Day Trading Rules In Canada Simplified Investing 101

What Is Forex Trading Forbes Advisor

Day Trading 2022 How To Day Trade Tutorials Expert Tips

Uk Tax In Forex Trading How Much Do I Pay 2022 Update

Is Forex Trading Legal In Canada Forex Trading In Canada Forex Education

China S Oil Giant To Exit Operations In Uk Canada And Us

7 Best Forex Brokers For Beginners In 2022 Forexbrokers Com

Forex Trading In Canada Is It Legal Do I Pay Taxes

Forex Trader Resume Sample Kickresume

Which Country Is Best For Forex Trading

Forex Trading Academy Best Educational Provider Axiory

What You Trade Can Make A World Of Tax Difference Green Trader Tax

Why Forex Trading Is Exploding Across Africa Rest Of World

How To Pay Taxes On Forex Trading Gains

Best Forex Brokers Canada 2022 Compare Top Brokers With Low Fees